EMI Calculator

Loan Payment Schedule

| Year | Opening Balance | Principal Payment | Interest Payment | Total Payment | Closing Balance | Loan Paid To Date |

|---|---|---|---|---|---|---|

| 2023 | ₹100,000 | ₹16,944 | ₹7,388 | ₹24,332 | ₹83,056 | 20% |

| 2024 | ₹83,056 | ₹18,350 | ₹5,981 | ₹24,332 | ₹64,706 | 40% |

| 2025 | ₹64,706 | ₹19,873 | ₹4,458 | ₹24,332 | ₹44,832 | 60% |

| 2026 | ₹44,832 | ₹21,523 | ₹2,809 | ₹24,332 | ₹23,309 | 80% |

| 2027 | ₹23,309 | ₹23,309 | ₹1,022 | ₹24,332 | -₹0 | 100% |

What is EMI?

EMI (Equated Monthly Installment) is the amount that you have to pay every month to the bank or any other financial instituation until the loan amount is completely paid off.

EMIs make it easier for normal people like you and me to make big ticket purchases like a house or a car and pay the amount in smaller installments through our regular salary or income. Taking a loan on an EMI is very common and most of you reading this article might have already taken some loan or may be planning to take a loan.

The monthly installments that you pay to the bank consist of an interest component and a principal component. The interest component completely goes to the bank. The principal component of the EMI is the amount that is reduced from your overall loan amount. The interest component of the EMI is higher during the initial months of the loan payment schedule and it reduces gradually with each payment. With each successive EMI payment, your payment towards the principal grows and the payment towards the interest reduces.

The exact allocation of interest component and the principal component of your EMI depends on the interest rate. If you take a loan on a higher interest rate, the interest amount that you pay to the bank will also be higher.

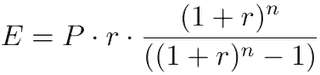

Here’s the formula to calculate EMI:

EMI Formula:

where

E is the EMI

P is Principal Loan Amount

r is rate of interest calculated on a monthly basis. (i.e., r = Rate of interest per annum/12/100. If rate of interest is 7.5% per annum, then r = 7.5/12/100=0.00625)

n is loan tenure / duration in number of months

For example, if you avail a loan of

₹10,00,000from the bank at an annual interest rate of7.5%for a period of10years (i.e.,120months), thenEMI = ₹10,00,000 * 0.00625 * (1 + 0.00625)120 / ((1 + 0.00625)120 - 1) = ₹11,870.

i.e., you will have to pay

₹11,870for120months to repay the entire loan amount. The total amount payable will be ₹11,870 * 120 = ₹14,24,400 that includes₹4,24,400as interest towards the loan.

Calculating EMI for your loan using the above EMI formula by hand or MS Excel or even through calculator is time consuming, complex and error prone.

Our simple and easy to use EMI calculator helps you with this calculation and gives you the result in a split second along with a ton of other information like the EMI payment schedule in the form of visual charts and tables. Our EMI calculator shows you individual break up of interest and principal amount for each month of the EMI payment.

How to Use EMI Calculator?

Our EMI calculator provides a simple and intuitive interface for you to calculate EMIs instantly along with beautiful charts and tables. You can calculate EMI for home loan, personal loan, car loan, bike loan, education loan, gold loan, land loan, home construction loan or any other type of loan provided by banks or non-banking financial institutions.

To calculate EMI, you need to enter the following information in the EMI Calculator:

- Principal loan amount that you want to avail (in the seleced currency)

- Rate of interest in percentage term (you can select the per annum or per month for the interest rate)

- Loan tenure (in years or months)

As soon as the you enter the values or change any of the values in the EMI calculator form, the calculator automatically kicks-in and calculates the EMI based on the values you have entered.

The EMI calculator will show your monthly EMI, the total interest payable during the entire tenure and the total payment including principal and interest. There is a pie chart as well that shows the break-up of total payment, i.e., how much you pay for the principal loan amount and how much towards the interest.

Apart from the payment break-up, we also provide the payment schedule (also called amortization schedule). The payment schedule starts from the current month by default but you can change it by selecting the month from which the payment should start.

The payment schedule chart shows the break up of principal amount and interest amount that you pay in each year during which your loan is active. There is a payment schedule table as well which shows even more details like the break up of interest and principal payment for each month during your loan tenure. The payment schedule table shows additional details like how much loan you have paid till date, and what is the remaining loan balance.